“There’s this company in the service industry in New Zealand which was owned and led by a particularly charismatic individual. The owner led the business from its startup status to the multi-million dollar enterprise that it is today. The initial growth was staggering, increasing monthly revenue twenty-fold in as many months. It quickly became apparent that the business started to stagger under this massive growth curve. Service levels started to drop due to poor operational planning or lack of management expertise. The staffing levels growth, whilst impressive, suffered from staff not sticking as a result of static management presence (the founder only) and lack of foresight to grow internal expertise as the business grew. The business started losing customers and revenues with it. The founder was an expert at growing the business but lacked the management skills to monitor this growth carefully and formulate a plan to handle it. In a worst-case situation, appropriate management skills are necessary to slow growth down, consolidate the service offering through the introduction of competent managers with industry expertise; and then, once done, reboot the growth activity. Thankfully, the founder sought counsel from external parties and this knowledge was sourced. The business was saved and it went on to become one of the top ten providers in their industry sector in New Zealand. No one is good at everything – ask for help.”

Kerry Holmes, SmartFreight’s Managing Director

Ready to take your business to the next level?

A top manager is considered as a strong, reliable and mature person who knows everything and can lead everyone in the ocean of business. That’s quite similar to what we feel about parents in childhood. But CxO is not a parent – he is a child. He has the same fears, uncertainty in his actions and belief in magic, with high responsibility level on top of all these. This problem is evident in growing companies that need to prepare for business boost or investment rounds. You hired great sales, he sold big projects (of course, in a few days, khe khe). Now you need engineers but salary funds are already off: you’ve hired expensive sales, remember? Worse, your company has a 90-day credit term. So stop dreaming and do budget.

Generally, budget is defined as estimated income and expense for the specific period. We’ll give it business perspective.

Generally, budget is defined as estimated income and expense for the specific period. We’ll give it business perspective.

Budget covers all monetary KPIs of your categorized business processes

Department managers set KPIs, such as % of leads generated via social media or actual construction hours. That is perfect for deep control and specific implementation, but needs to be brought to common base on the company level. And this base is money. Calculate expected processes result in dollars, and they will become manageable on any level of details.

“Budgeting is like putting down on paper how much money you want to make. The common equation of “Revenue less Costs equals Profit” is NOT what budgeting is about. Budgeting is about detailing all your needs, wants and DESIRES in a document that will tell you the financial viability of all these needs, wants and desires. A budget is not all about numbers. A good budget needs to have an operational plan to support it. For example, the revenue budget is to sell X number of widgets. Have a plan that supports doing just that. Detail how many widgets you need to sell to achieve the revenue target. Then, detail advertising expenses (trade shows, sales calls, etc.) needed to sell that many widgets. Show how many sales leads (as not all lead to a sale) you will need to achieve the targeted number of sales calls; and, finally, how many prospects you need for such leads It’s like reverse engineering your revenue target through the activities you plan to get to it. A good budget is only half the story – the other half is the detail of what activities you need to do, to do the budget”

Kerry Holmes, SmartFreight’s Managing Director

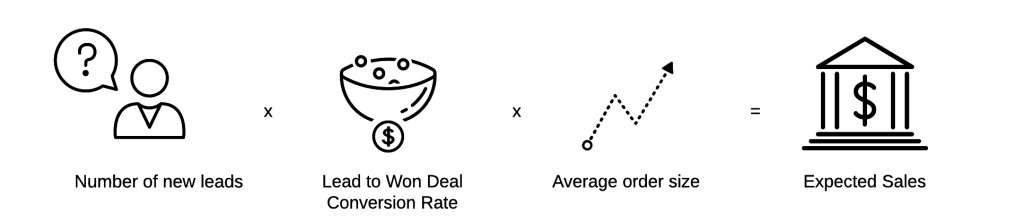

Marketing Executives define target as Number of Leads. The common expression will be achieved after multiplying the Number of Leads by Average Order Size. This way, the Owner or CFO can manage income lines in the unified USD Units.

— Example of Marketing KPIs expressed in monetary values

— Example of Marketing KPIs expressed in monetary values

Main budgeting objectives are

- Company’s stable growth

- Control

Main budgeting objectives are: company’s stable growth and control

These objectives are achieved by

- Categorizing all operations

- Defining dollars for all operations

- Managing cash flows

- Identifying funds and resources

- Playing with various scenarios

Budgeting is treated as an advanced comprehensive activity, because it requires forecasting and categorization skills. Below, we’ll show several tips to make it easier.

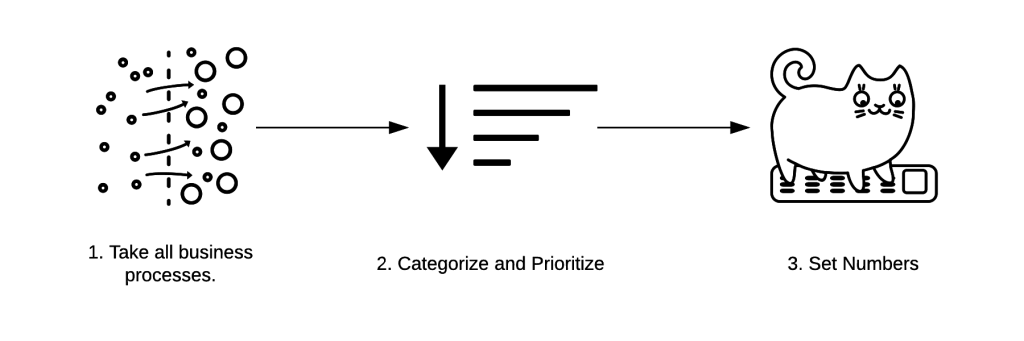

Perfect budget receipt is, in its definition, written earlier

Perfect budget receipt is, in its definition, written earlier

- Take all business processes

- Categorize and Prioritize

- Set numbers. Here you need to play a little bit

Focus on cash flow and income/expense groups – they are integral to a perfect budget

Split all processes and funds into two main categories

Split all processes and funds into two main categories

- Income

- Expenses

Some tips for effective budgeting

- Plan key manufacturing operations first. For example, Project Management for Odoo Software Development Company. If integrals were only properly planned, this would already position the business on the safe side.

- Keep budgeting simple where possible. The goal is to control and act immediately. Overloaded presentation of numbers will block decision makers.

- Do several models by trying various combinations. For example, play with Inbound Marketing and Direct Sales budgets to model optimal performance.

Do risks multiplication. There is a viral principle of software project managers to multiply all estimations by 2.5 times. The same ratio can be applied to both Income and Expenses, as denominator and multiplicator, correspondingly. Looks scary? At least, you have planned for the worst-case scenario now.

Summary

Budgeting is not just presenting your targeted revenue and expected expenses on paper. Budgeting leaves you one to one with paper and numbers. Whole picture of incomes and expenses will be fully formalized now. It is not so complex just to split all key operations into two categories and model your business on paper. The resulting annual budget will give you much more control over your business. Budgeting should be based on relevant and accurate financial data. We assist our customers in setting up accounting and configuring finance reports in Odoo ERP. Here are a few examples:

- From Budget Overruns to a Profitable Tech Company

- How Odoo ERP Helped a Swiss IT Service Company to Grow Turnover 2.5 Times

This is the first article in a budget planning series. Most examples are suited to service and high-technology companies that experience first- or second-growth wave. But companies from other industries and business states could find useful tips from this resource, too.

Topics to be covered in the next articles

- Full budgeting memento

- Budgets templates

- Budgeting approval workflow

- Budgeting by business unit and embedding into whole company numbers.

- Budget control and checkpoints

- Budgeting postmortem analysis

- Projects budgets micro-planning

Special thanks to Kerry Holmes and Ben Woodward, SmartFreight, who helped in the article writing.

Optimize Your Finances with Odoo ERP

Working in IT industry full time since 2006 (as technical and functional expert)

Leading IT teams (technical and non-technical) since 2007

Lots of experience with ERP systems covering different company sizes (Oracle, Odoo)

Co-founded 2 startups (since 2010) before ending up working in business automation. Having 3 publications in Life Science

Since 2012 focusing on business automation using Odoo ERP. Is recognized as well-known expert

Working with customers across the globe (mostly NA, EMEA)

Having huge experience in Finance (managerial accounting) and Supply Chain (Logistics, Inventory, Purchase)

Passionate about creating new IT products. Having high demands to product's quality and level of customer support

Visioner and inventor in the VentorTech company.

----------------------------------------------------------------------

Education: Master.

----------------------------------------------------------------------

Experience:

Software Maintenance Team Leader

EPAM Systems

Co-founder

Boostant

СTO, Co-founder

XPANSA Group

----------------------------------------------------------------------

Current position: CEO & COO at VentorTech

----------------------------------------------------------------------

Since 2012 focusing on business automation using Odoo ERP. Is recognized as a well-known expert

- Working with customers across the globe (mostly NA, EMEA)

- Having a huge experience in Finance (managerial accounting) and Supply Chain (Logistics, Inventory, Purchase)

2 Comments

Eric

Awesome articles :) definitely look forward if you could share examples of budget template and plans too :) however it would be great if you could show how this can be managed within Odoo itself. Other than that, do you plan to cover any articles on project based budgeting?

Roman Gurinovich

Hi Eric,

thank you very much! Next materials will answer all your questions.

We are planning series of articles including templates, examples and ERP specific instructions. Follow our newsletter or Twitter to be updated.

Roman