Why switch from QuickBooks to Odoo?

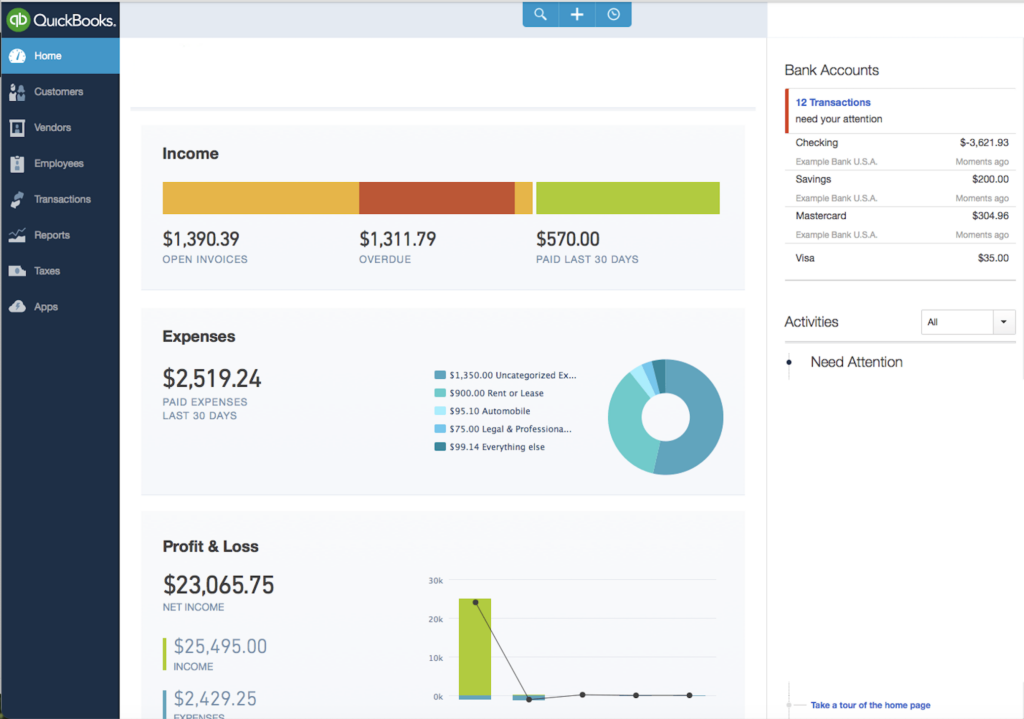

If you are an American midsize manufacturing or distribution company with 25 to 50 million dollars in revenue and about 50 employees, the chances are that you use QuickBooks to do your accounting. You’ve likely been using this traditional application for ages and it became ingrained into your company’s operations and culture.

But as your business grows and gradually adopts additional systems, such as manufacturing, inventory management, or spins off uncontrollably into various Excel-based workflows, you might notice that the information required for effective QuickBooks usage and accounting operations is lagging and lacking accuracy. Integrating and consolidating systems becomes crucial to streamline operations, enhance efficiency, and foster growth, while moving to a unified ERP platform like Odoo enters IT and business discourse.

Odoo, as a fully integrated ERP system, among other things, offers real-time inventory management with continuous updates as goods are received, transferred, or sold. This includes live tracking of stock levels, automated reordering, and integration with multiple warehouses. Inventory quantities and costs adjust instantly with each transaction, allowing for accurate, timely, and fully automated accounting updates. In QuickBooks, as an accounting system, real-time inventory tracking is limited and generally not as comprehensive. Basic inventory features like tracking stock levels are available, but they lack the automation and multi-warehouse support. Advanced features offered by third-parties require integrations for real-time tracking, which is costly and not as seamless.

“From my own personal experience, inventory management is a huge, probably the biggest, single reason to migrate fully to Odoo. It’s a lot easier to have all of your accounting accurate when your inventory is real time and up to date.” – William (B.J.) Lawson, Dooable Health, 🇺🇸USA, North Carolina, Apex.

Because Odoo (unlike QuickBooks) regularly tends to a comprehensive set of business areas, it brings valuable features and data from those areas into accounting.

As an example, QuickBooks lacks a built-in landed cost functionality. To overcome that, users need to manually add expenses to inventory or use workaround methods, such as allocating costs to a cost-of-goods-sold account, which is awkward and inefficient. Odoo allows complex cost allocation. Landed costs specifically are managed through a dedicated feature that allows additional expenses (e.g., freight, customs, and insurance) to be allocated to specific products, while automatically distributing these costs across items based on weight, volume, or value. This accurate cost allocation helps with margin analysis and inventory valuation in real-time—as a big bonus for accounting.

As the company grows and deals with more suppliers and customers, the ability to exchange invoices, purchase and sales orders, etc. electronically becomes a priority. QuickBooks primarily supports standard PDF and XML formats for invoices, along with HTML-based formats for digital viewing. But Odoo offers direct out-of-the-box support for structured EDI formats like Peppol BIS or Factur-X (CII), which will save you from many headaches when setting up EDI (Electronic Data Interchange). This is pivotal not only for working with your business partners but also for crossing country borders or meeting government requirements for fiscal controls.

Key Phases in Migrating from QuickBooks to Odoo

1. Gaining Organizational Buy-In

Before diving into migration, securing buy-in across departments is key. Odoo’s comprehensive feature set, along with its modern interface and stunning performance, makes it attractive to various teams—from warehouse operations to purchasing. While this might be an exciting news, it also presents a danger zone. Premature optimism driven by basic demos shifts the focus from real needs to trifle niceties and can also lead to missing important distinctions between Odoo and QuickBooks (see #3 below).

Instead, the best place to start is by examining current processes, identifying most painful gaps or pressing needs, and demonstrating potential improvements with Odoo.

2. Requirement Gathering and Accounting Involvement

The process examination naturally leads to documenting functional requirements with expected benefits and improvement goals, preferably substantiated by KPI (Key Performance Indicators).

In this requirements-gathering exercise, accounting and finance must be involved from the start. Offering them a leading role in the ERP implementation project will help to secure the engagement. Since accounting is the primary consumer of the data flowing into the ERP system, early involvement is critical to prevent downstream complications. As a quick example, Odoo’s default terms for a purchase ship is DAP (Delivered at Place), and sales ship is FOB (Free on Board). If those defaults don’t align with the business’s actual practices, adjustments should be discussed thoroughly, agreed on, and configured/coded well before launch.

3. Recognizing Differences Between QuickBooks and Odoo

Transitioning to Odoo from QuickBooks involves adapting to Odoo’s unique structure, especially in analytics and reporting. QuickBooks offers a broad range of pre-built reports and filters familiar to many U.S. and Canadian businesses. This is not the case with Odoo, where the reporting functionality might look even primitive (compare: QuickBooks has 25 date range selectors versus 6 in Odoo). This can become a serious issue and a barrier, especially with senior management accustomed and often addicted to very specific reports with very particular designs.

However, Odoo compensates with powerful tools like pivot views, customizable dashboards, and the ability to work with granular data, allowing users to create more adaptable, actionable reports over time. There is also a big community of developers who create various reporting add-ons for different business needs.

Odoo’s open source allows for endless customizations and tweaking, whereas in QuickBooks you are already capped at what you have out of the box.

4. Configuration, Customization, and Adaptation

While Odoo can generally meet most business process requirements, balancing between customizations and adapting to Odoo’s workflows is essential and must be done carefully.

For instance, Odoo’s offering of the aforementioned landed costs functionality eliminates manual adjustments needed in QuickBooks, and it’s a clear opportunity for adopting Odoo’s approach and dropping whatever procedures were executed in QuickBooks. But there could be cases where a unique and valuable business process or feature cannot be enabled through Odoo’s standard configuration, which warrants customization. A good case must be made and examination carried out, however, to prove that the process/feature in question is truly valuable and not just a habitual artifact in need of streamlining.

Customizations in ERP are considered a bad idea in general and should be avoided when possible. This consideration also provides an organization with an incentive to review business processes in search of improvement opportunities unrelated to ERP implementation per se but hopefully supported by it.

5. Potential Integration

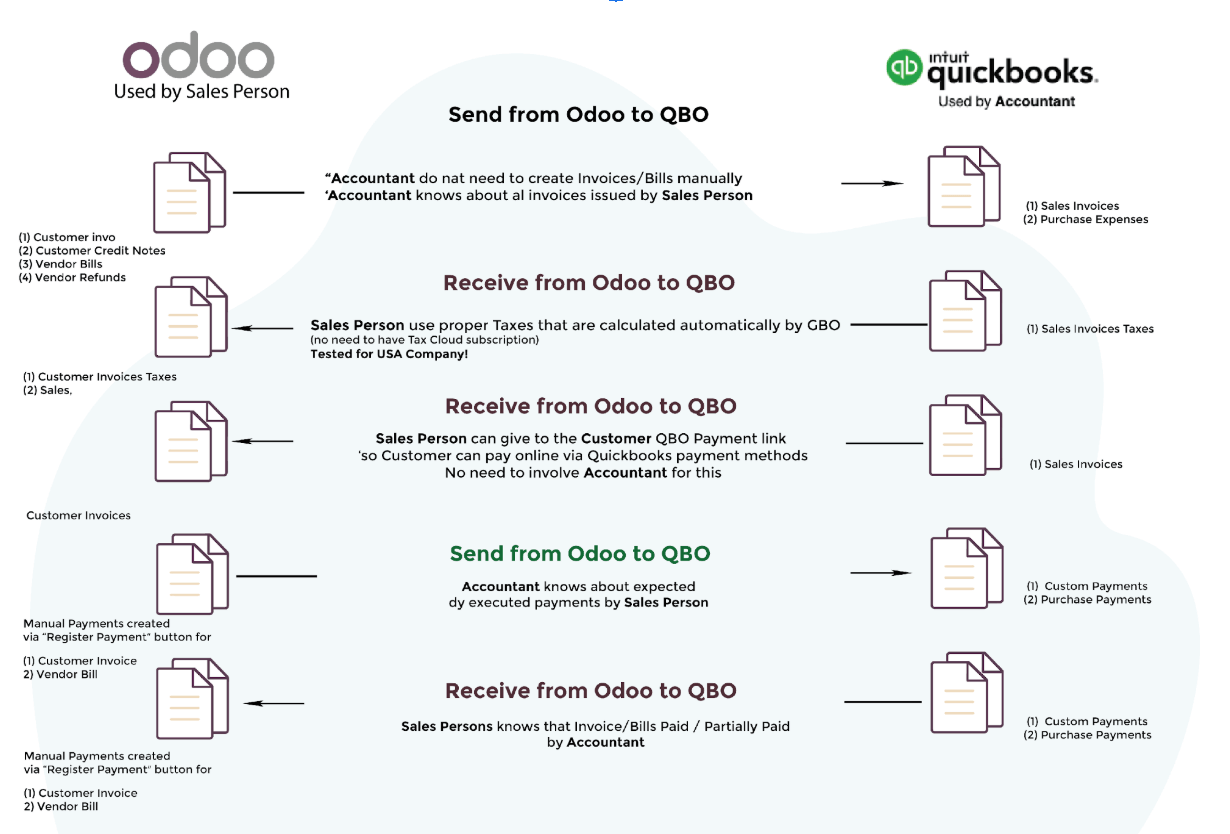

For organizations hesitant to move entirely away from QuickBooks, VentorTech offers a solution: a connector that synchronizes accounts receivable and payable data between QuickBooks and Odoo. This approach enables parallel operation while maintaining consistency in familiar financial reporting. The connector also simplifies tax calculations (which Odoo does differently from QuickBooks) by synchronizing data between two systems, thus preventing inconsistencies.

While this is not the optimal approach, at least from the technical point of view, it does allow for alleviating the pains of a drastic change, staging the implementation, and easing into the new ERP world gradually while keeping senior consumers of the financial reports happy and supportive of the project.

6. Data Migration Best Practices

Migrating data from legacy systems is tedious and tends to be very labor intensive. But it is one of the most important activities in implementing ERP. VentorTech has extensive experience and a rich toolset for ensuring that data migration has a consistent, robust, and repeatable ETL (Extract, Transform, Load) design with the most accurate output. Odoo also has a comprehensive external API (Application Programming Interface) that facilitates such designs.

Manual data entry should be avoided, as it is prone to errors and is time- and labor-consuming. Instead, a structured, automated migration process should be used that aligns with Odoo’s agile, iterative implementation. VentorTech automates Odoo data imports with an easily reproducible ETL pipeline where data migration exercise is conducted many times, which ensures familiarity with the process and its accuracy, making a final go-live data migration a non-event.

7. Validation and Launch

Similar to data migration repetitions, an iterative release process for user validation on a regular (e.g. weekly) basis ensures that the official production launch is just another and final iteration when everyone is comfortable with Odoo’s features, functionality, and data integrity. A well-rehearsed, automated process makes going live a matter of routine, which enables teams to achieve a smooth transition.

This final stage includes validating data, gathering user feedback, and seeking final sign-off.

Conclusion

Migrating from QuickBooks to Odoo requires careful planning and buy-in across all departments. By defining requirements, engaging finance teams early, leveraging Odoo’s unique features, automating data migration, and repeating release and validation activities, companies can achieve a smooth transition and accelerate process workflows across various functions while maintaining productive accounting—with or without QuickBooks.

Partnering up with experienced system integrators with the right toolset and systemic approach to such migrations is essential.

Considering taking steps to a QuickBooks-to-Odoo migration?

- Odoo QuickBooks Online Connector

- How Odoo implementation automated 10 months of manual work and saved over €22K annually

- Odoo Success Story: From Budget Overruns to a Profitable Tech Company in Just 6 Months

- 10 most common questions to the official Odoo partner

0 Comments